Road to $100k - Week 40

Week 40 Performance Overview

- Current Account Balance: $10,347

- Cash Balance: $552

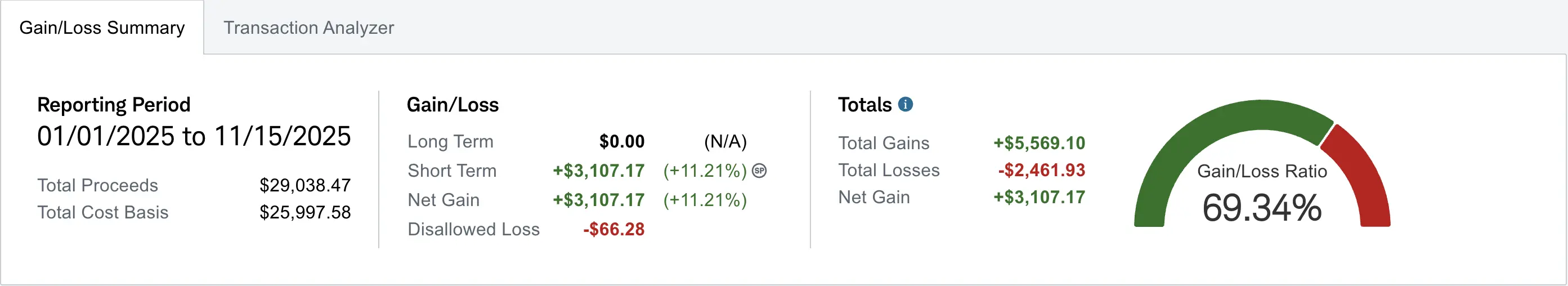

- Realized gain of $3,107 (up +$77 from Week 39)

- Softbank sells entire stake in NVDA

- AI data centers and crypto sector pulled back

- October CPI won’t be released; could impact December Fed cut

Tough week given crypto exposure and broader weakness in AI-adjacent names. I still focused on collecting premium to further lower my adjusted cost basis.

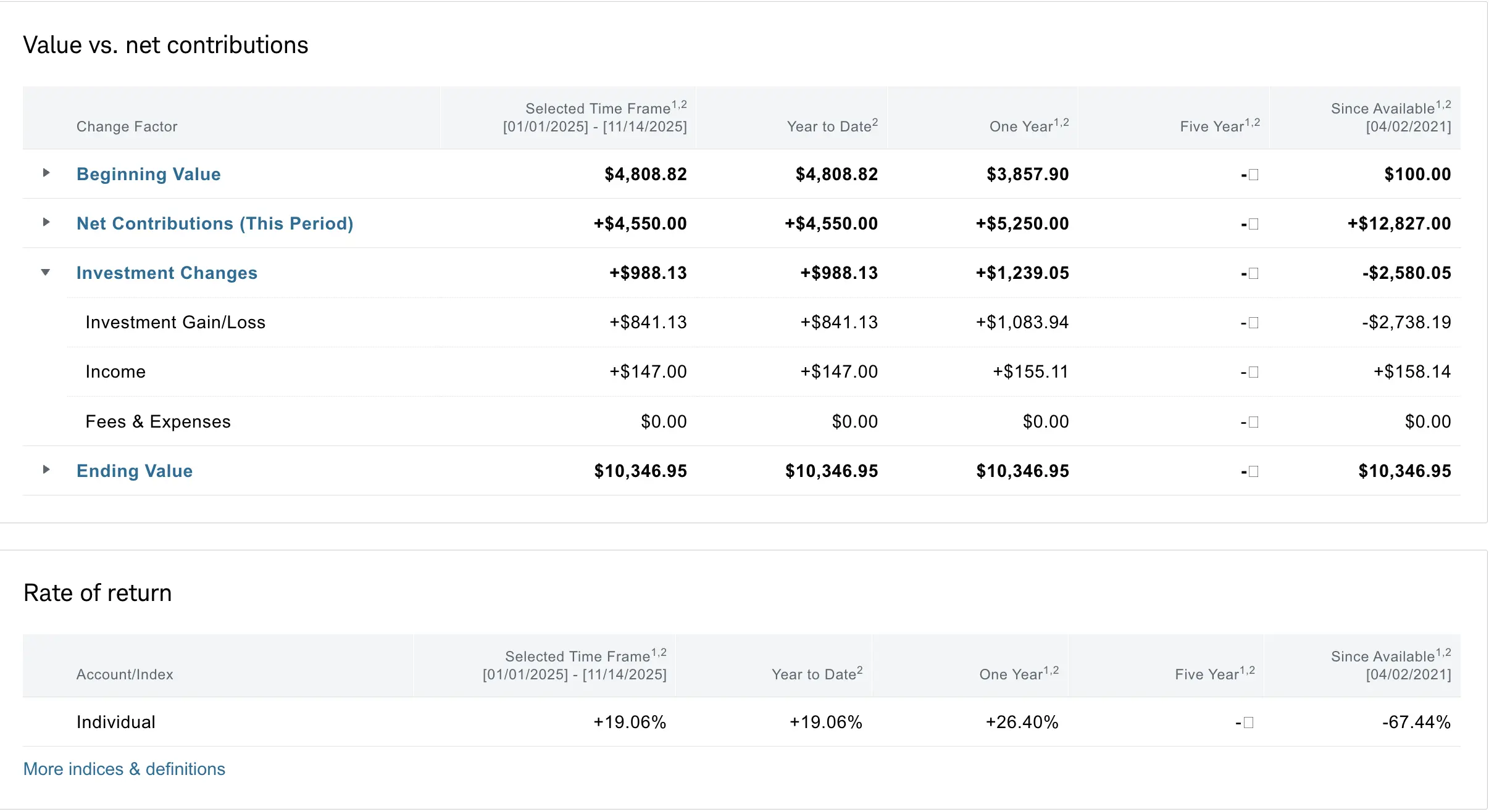

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about -$2,580 despite contributing over $12.8K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+19.06%) and YTD (+26.40%) performance metrics are what truly matter for tracking this journey.

Market Recap

Headlines were dominated by Softbank exiting NVDA, pressure across AI data center names, and a sharp pullback in crypto. October CPI not being released adds uncertainty into December’s Fed cut debate.

My Week 40 Trades

$MSTX

Got hit alongside MSTR and Bitcoin weakness. I sold covered calls to lower adjusted cost basis and will keep cycling premium.

-

11/10/2025 Sell to Open:

- MSTX 11/14/2025 14.00 C

- Quantity: 3

- Premium: $0.07

- Fees: $1.54

- Net Credit: +$19.46

$PSKY

Sold covered calls to keep premium flowing while monitoring Paramount earnings and streaming plans into 2026. Will roll as needed.

-

11/10/2025 Sell to Open:

- PSKY 11/14/2025 17.00 C

- Quantity: 2

- Premium: $0.10

- Fees: $1.03

- Net Credit: +$18.97

$AES

My $14 CSP expiring 11/14 was assigned; I’ll start selling covered calls on the shares next week. I also opened another $14 CSP for 11/21.

-

11/10/2025 Sell to Open:

- AES 11/21/2025 14.00 P

- Quantity: 1

- Premium: $0.41

- Fees: $0.51

- Net Credit: +$40.49

$BULL

Holding 200 shares and did not sell covered calls this week. Earnings are upcoming; I may wait until after to sell calls.

Looking Ahead

Planning to sell covered calls on AES next week, continue cycling CCs on MSTX and PSKY, and reassess BULL positioning after earnings.

What I'm Holding Now

As of November 16, 2025, here's what's in my portfolio:

- $552 cash on hand

- 300 shares of MSTX

- 200 shares of PSKY

- 200 shares of BULL

- 100 shares of AES (assigned 11/14)

- AES Cash secured put ($14 strike 11/21 exp)

- Weekly $100 deposit on Wed and Fri splits