Road to $100k - Week 39

Week 39 Performance Overview

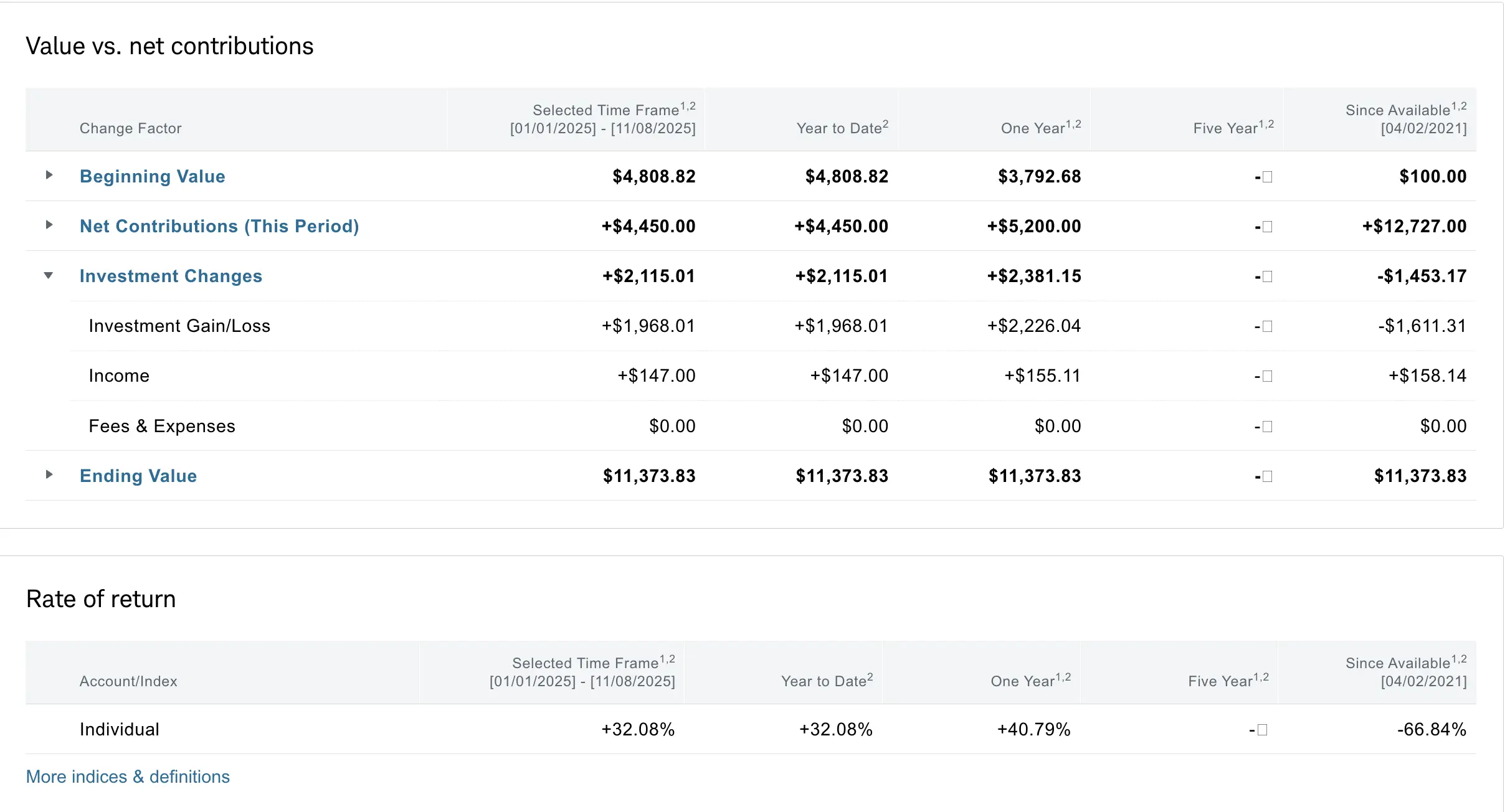

- Current Account Balance: $11,373

- Cash Balance: $1,773

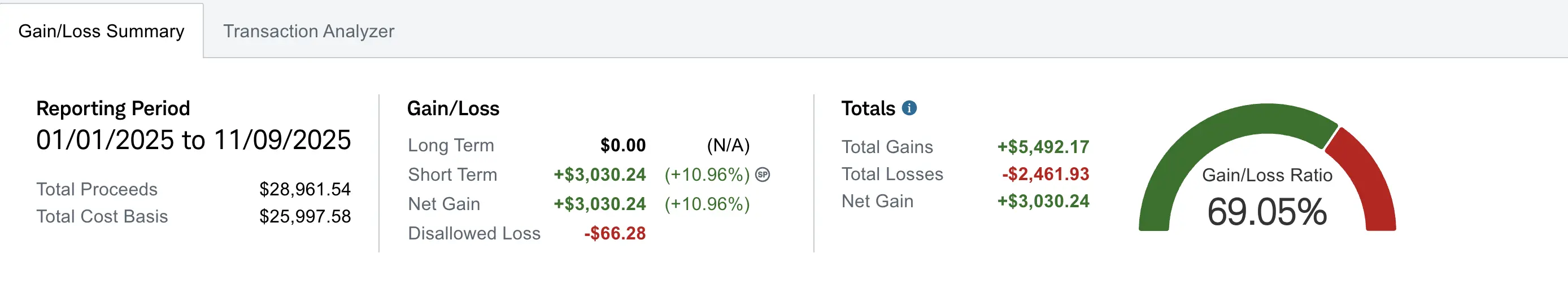

- Realized gain of $3,030 (up +$93 from Week 38)

- Government shutdown continues and is starting to impact markets

- Michael Burry disclosed a short position targeting AI-related themes

- Crypto-related names broadly pulled back

This week saw a modest pullback across several themes, with utilities remaining relatively stable compared to AI and crypto. I collected a few premiums, my motto goes collecting something is better than collecting nothing.

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about -$1,453 despite contributing over $12.7K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+40.79%) and YTD (+32.08%) performance metrics are what truly matter for tracking this journey.

Market Recap

The ongoing government shutdown is beginning to weigh on sentiment and price action. Michael Burry’s announcement of a short position against AI-related themes added pressure to that segment. Crypto also pulled back, contributing to a more cautious tone in risk assets.

My Week 39 Trades

$AES

Entering this week, I held $AES $14 cash secured puts expiring 11/07 which expired worthless for a net profit of +$36.00. I opened a new $14 cash secured put expiring 11/14 for additional premium.

-

10/30/2025 Sell to Open:

- AES 11/07/2025 14.00 P

- Quantity: 1

- Net Profit: +$36.00 (expired worthless)

-

11/06/2025 Sell to Open:

- AES 11/14/2025 14.00 P

- Quantity: 1

- Net Credit: +$35.00

The utilities sector remains comparatively stable versus AI and crypto. I’ll continue to bid $AES as the Blackrock buyout remains on the horizon.

$MSTX

I was assigned on the $MSTX $15 cash secured put last Friday. This week I sold $15 covered calls for premium that expired worthless on Friday; realized gains will reflect on Monday.

-

11/03/2025 Sell to Open:

- MSTX 11/07/2025 15.00 C

- Quantity: 1

- Net Credit: +$25.00

I also had a $12 cash secured put opened last week for +$39.00 which was assigned this week at an adjusted cost basis of $11.61. In addition, the $14 CSP that I rolled down to $13 last week was assigned with an adjusted cost basis of $12.65.

-

10/29/2025 Sell to Open:

- MSTX 11/07/2025 12.00 P

- Quantity: 1

- Net Credit: +$39.00

-

10/31/2025 Roll:

- Buy to Close: MSTX 10/31/2025 14.00 P (Debit: -$20.00)

- Sell to Open: MSTX 11/07/2025 13.00 P (Credit: +$55.00)

- Net Credit: +$35.00

I now have 300 shares of MSTX with a adjusted cost basis around $13. I could sell covered calls at $13, but I plan to continue selling $15 calls to capture potential upside.

$PSKY

I sold $17 covered calls for a total net credit of +$8.00 on 2 contracts. While waiting on the WBD and PSKY merger to play out, I’m collecting premium rather than sitting idle. These calls expired worthless on Friday.

-

11/03/2025 Sell to Open:

- PSKY 11/07/2025 17.00 C

- Quantity: 2

- Premium: $0.04

- Net Credit: +$8.00

$BULL

I sold covered calls at $12 and $12.5 strikes for a combined net credit of +$11. I’ll continue selling covered calls to lower my adjusted cost basis while reiterating that collecting something is better than collecting nothing.

-

11/03/2025 Sell to Open:

- BULL 11/07/2025 12.50 C

- Quantity: 1

- Premium: $0.04

- Net Credit: +$4.00

-

11/03/2025 Sell to Open:

- BULL 11/07/2025 12.00 C

- Quantity: 1

- Premium: $0.07

- Net Credit: +$7.00

Looking Ahead

This was a relatively light week amid the pullback. I’ll continue selling covered calls in the coming weeks and stay alert for any progress on a government shutdown deal, which could drive a reversal.

What I'm Holding Now

As of November 9, 2025, here's what's in my portfolio:

- $AES $14 cash secured puts exp 11/14

- 300 shares of $MSTX

- 200 shares of $PSKY

- 200 shares of $BULL

- Weekly $100 deposit split between Wednesday and Friday

- $1,773 cash balance for any opportunity