Options Trading Journey: $6K to $100K - Week 21

Week 21 Performance Overview

- Current Account Balance: $9,043

- Short trading week due to July 4th holiday

- US announced a trade deal with Vietnam setting imports at 20% rate and opens Vietnam market to US automakers

- Tesla delivery numbers came in lower than expected

- Elon Musk announced the creation of the American Party for 2026 midterms

- Managed positions in $TSLL

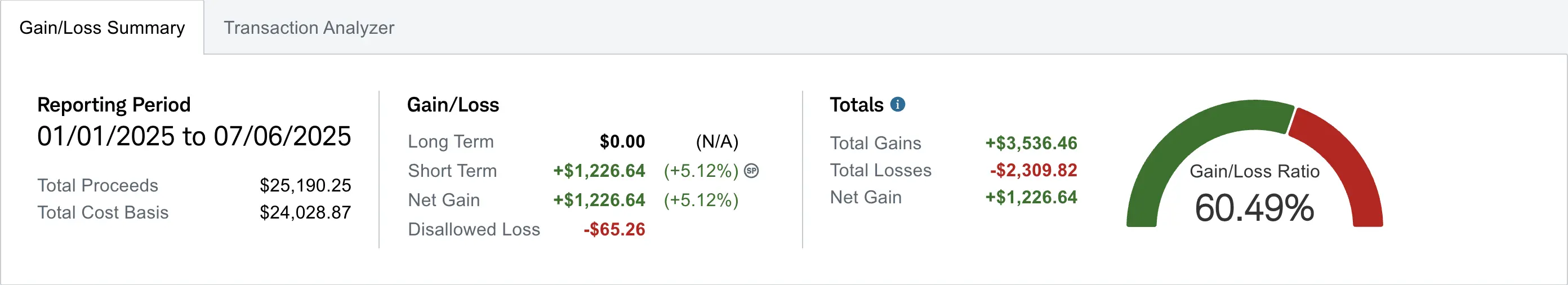

- Realized gain of $1,226.64 (up +$28.45 from Week 20)

Portfolio Performance

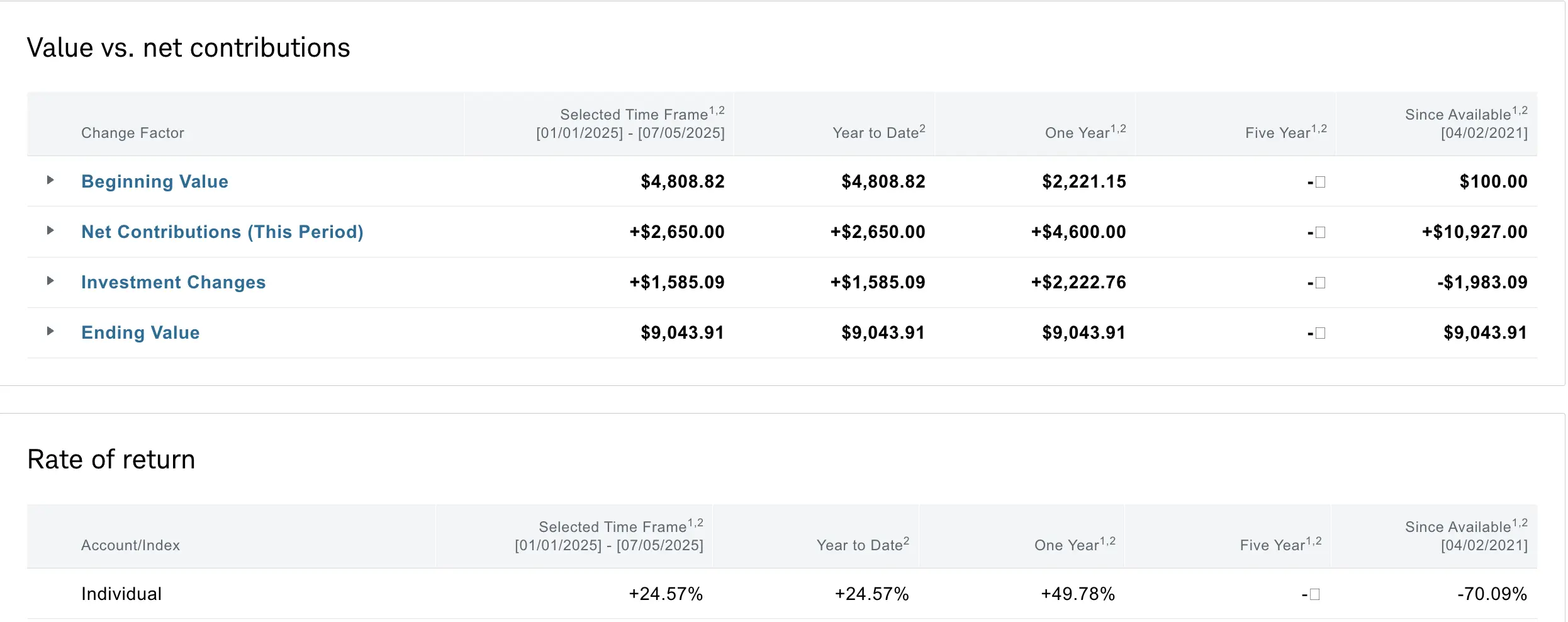

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $1,983 despite contributing over $10.9K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+49.78%) and YTD (+24.57%) performance metrics are what truly matter for tracking this journey.

Market Recap

This week was a short trading week due to the July 4th holiday, which limited trading activity. The US announced a trade deal with Vietnam that will set imports from Vietnam at a rate of 20% and opens the Vietnamese market for US automakers. Tesla's delivery numbers came in lower than expected, but the market largely brushed off this news. The "Big Beautiful Bill" passed as the market continued to rally. Additionally, Elon Musk announced the creation of the American Party as a challenger in the 2026 midterm elections for Senate and House seats.

My Week 21 Trades

$TSLL

I rolled down and out my $10.5 strike cash secured puts expiring 07/03 to $10 strike expiring 07/11 for a net credit of $14 ahead of Tesla's delivery numbers. I had anticipated that the delivery numbers would be lower than expected given the recent trend of declining auto sales. I wanted to position ahead to give my position wiggle room in case I needed to roll down again. Given this weekend's American Party announcement by Elon Musk, I expect TSLA to face some pressure next week. However, my thesis on TSLA remains intact as they continue to position themselves as an AI/Robotics company rather than just an automotive manufacturer.

-

06/30/2025 Buy to Close:

- TSLL 07/03/2025 10.50 P

- Quantity: 2

- Debit: -$32

-

06/30/2025 Sell to Open:

- TSLL 07/11/2025 10.00 P

- Quantity: 2

- Credit: $46

- Net Credit from rolling: $14

$GME

My previous $GME cash secured puts expired on Friday and settled in my account on Monday, increasing my realized gain YTD to $1,226.64.

What I'm Holding Now

As of July 6, 2025, here's what's in my portfolio:

- 2 cash secured puts on $TSLL at $10 strike (07/11 expiry)

- $7,067.91 Cash reserves awaiting potential market pullback opportunities

- I still maintain a weekly $100 deposit on Wed and Fri splits.

Looking Ahead

With my only open position being the $TSLL cash secured puts, I'm maintaining a significant cash position of $7,067.91 as I await potential pullback opportunities. I'll continue to monitor market conditions closely, particularly focusing on how Elon Musk's American Party announcement might impact Tesla's stock price in the coming weeks. As always, I'll be scanning daily using the options scanner and staying flexible to adapt to changing market conditions.

Join the FREE trading community focused on selling options, sharing setups, and building consistent income:

Selling Options Discord